An investment of over 5 million yuan in a brand-new robotic sorting production line could mean a 20 percentage point increase in recycling rate within a year for a material recycling facility processing 100,000 tons annually, or it could lead to hefty fines due to compliance issues within the same year.

With increasingly stringent policies globally regarding landfill transfer and recycled material content requirements, the traditional sorting machine is struggling to meet new purity standards and data traceability requirements. Policy is a Damocles’ sword directly impacting the survival of businesses.

1. Policy Pressure

The Extended Producer Responsibility (EPR) system is moving from advocacy to mandatory enforcement.

The EU has clearly stipulated that by 2030, all packaging must be recyclable and meet specific recycled material content thresholds.

The core shift in policy lies in the substantial extension of responsibility.

According to the interpretation on the China Environment Network, the responsibility of hazardous waste generators “should never end with the entrustment, but must extend to ensuring that it receives legal, safe, and environmentally harmless final disposal.”

This means that if a waste sorting center‘s equipment inadequately results in substandard downstream recycled products, the entrusting party (brand owner) may not be able to absolve themselves of liability on the grounds of having entrusted the disposal; instead, they may face joint liability or prior compensation liability.

Legal provisions are closing the loophole of exemption from liability upon entrustment.

For sorting centers, whether the received materials are effectively and with high purity sorted is no longer just a business issue, but also a legal responsibility issue.

2 Risk Calculation

The hidden costs of the outdated waste sorting machine far exceed expectations. Under a strict EPR framework, the risks posed by traditional equipment can be quantified.

First, there is compliance risk.

If sorting purity fails to meet standards, resulting in the client’s brand’s products not meeting policy requirements for recycled material content, the brand will face fines. This cost may be partially transferred to the upstream sorting (sorting link/stage) based on the principle of joint liability.

Second, there is economic risk.

Recycled materials produced from low-purity sorting have low market value. For example, color-sorted, pure PET and HDPE can fetch 30% more than their mixed-bag equivalent.

A traditional sorting line may show millions in savings on paper for replacement costs, but the annual losses due to the production of low-value recycled materials and potential compliance penalties may far exceed equipment depreciation.

3 Intelligent Waste Sorting

The core value of intelligent sorting lies in precision and data.

The real-world example of a waste compression station in Guangzhou is even more convincing.

The high-speed AI sorting robots introduced at this station achieve a sorting speed of up to 5400 times per hour, reducing waste volume by over 40%. By efficiently recycling high-value recyclables, the project generates approximately 1 million yuan in additional revenue annually.

More importantly, the digital systems equipped with these intelligent devices can record and trace the processing and purity of each batch of materials in real time, generating irrefutable compliance data reports—a core tool for addressing EPR accountability.

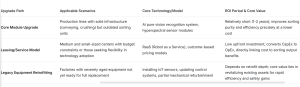

4 Upgrade Paths

First, there’s the core module upgrade.

For sorting lines with a sound infrastructure, modules like conveying and crushing can be retained, with a focus on upgrading the core identification and sorting units. For example, adopting a pure vision AI recognition system can significantly improve sorting accuracy at about half the cost of traditional optical equipment.

Second, there’s the leasing and service model.

To alleviate the pressure of high capital expenditures, equipment manufacturers have launched service-based leasing or Robots as a Service (Robotics) models. This model shifts expenditure from fixed asset investment to operating costs, lowering the investment threshold and initial cash flow pressure.

Finally, there’s the intelligent transformation of the older waste sorting machine.

This isn’t just about maintenance; it involves adding sensors and updating control systems to give older equipment some data collection and intelligent analysis capabilities. Some traditional factories in China have already achieved a 20% increase in picking capacity by revitalizing 280,000 yuan worth of idle materials through this type of transformation.

The table below clearly compares the three mainstream equipment upgrade paths to help you make a decision based on your own situation.

5 The Investment Value of Waste Sorting Machine

In the EPR era, investing in an advanced waste sorting machine is far more significant than simply purchasing production tools. It represents a profound strategic transformation: from a cost center passively undertaking processing tasks to a profit and risk-mitigation center proactively creating compliance and material value.

The equipment no longer simply outputs sorted waste, but rather data-backed, high-purity, traceable recycled materials. This elevates the sorting center from the end of the industrial chain to a key partner for brands achieving circular economy goals and fulfilling their legal responsibilities.

Furthermore, this upgrade, aligned with policy and technological trends, may become an implicit barrier to obtaining government projects, subsidies, and even industry entry in the future.